While a daughter mourned her father, a scammer saw an opportunity.

The Washington Post recently shared a story that should alarm every property owner. While a woman grieved her father’s death, a complete stranger filed forged documents with the county claiming he’d bought the property for $10. The signature was fake. The witnesses were fabricated. One witness had even died before the supposed sale.

The county clerk recorded it anyway.

Six months and $60,000 later, the grieving daughter finally reclaimed what was rightfully hers. But only after hiring attorneys, filing police reports that went nowhere, paying a private investigator, and begging judges to see reason. The clerk’s office told her their job is to record deeds, not verify them. The police said it was a civil matter. The first judge dismissed her case on a technicality, even with proof the document was fraudulent.

This is far from an isolated incident. A 92-year-old Dallas woman lost her property to deed fraud in 2023, discovering it only when her daughter spotted a “For Sale” sign in the yard. Two people face charges in New York for allegedly stealing a home while the owner lay in hospice.

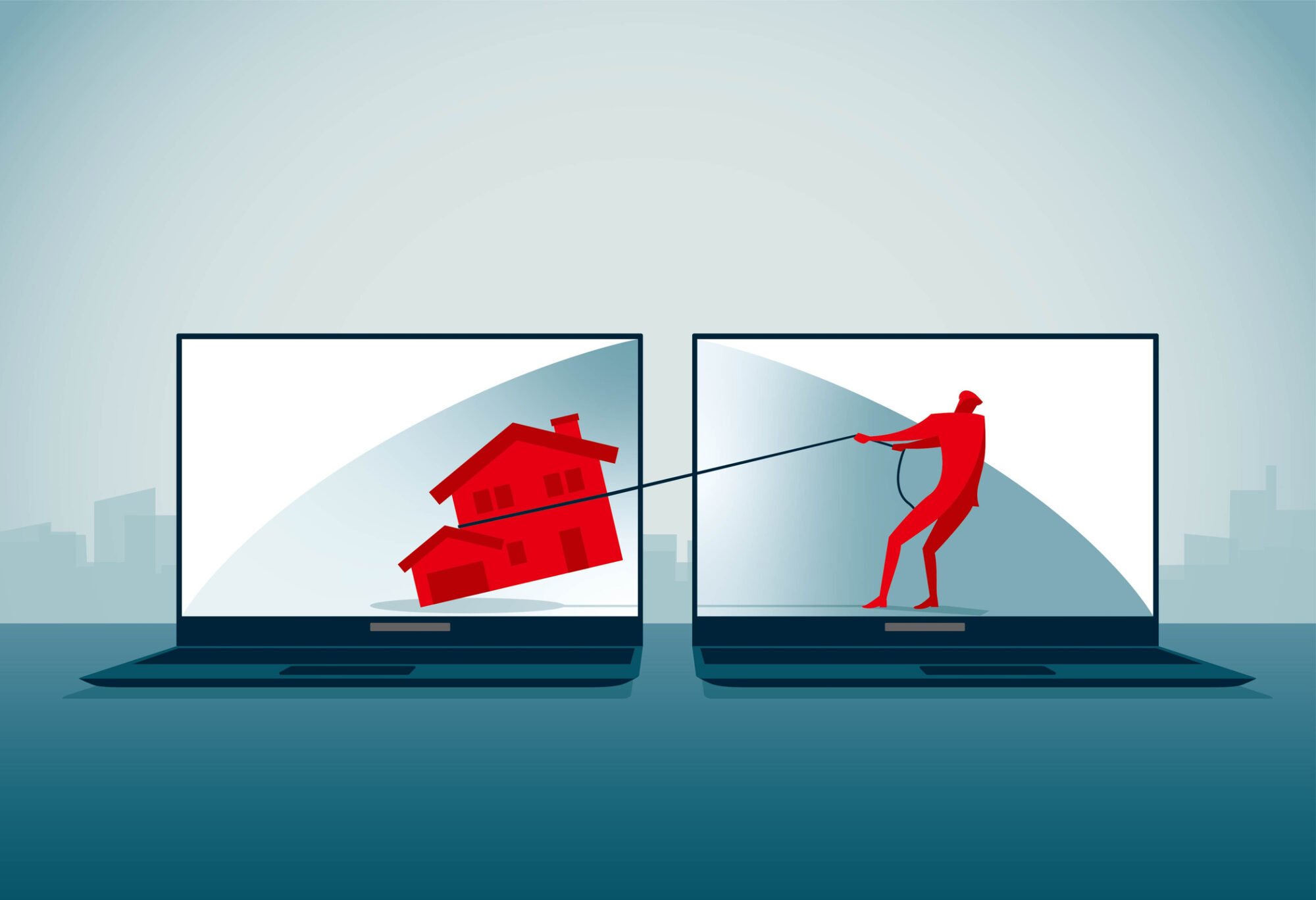

Law enforcement agencies across the country warn these crimes are rising. The system has a glaring weakness: anyone can file a deed, and once it enters the public record, unwinding the damage requires expensive lawyers and months of court battles.

Prevention First, Prosecution Later

Computer Systems, Inc. saw this problem coming and partnered with Equity Protect, which does what county clerks can’t do: It keeps an eye on potential fraud after the deed is recorded and blocks fraudulent property transfers before they happen. No waiting for a surprise letter from a lawyer—because unauthorized changes never get through in the first place. Their proprietary system stops fraudulent deeds at the source, preventing them from ever entering the public record.

The attorney in the WaPo story noted that placing the property in a trust would have prevented the entire nightmare. But most homeowners haven’t taken that step. For them, real-time monitoring offers protection without restructuring their assets.

While the grieving daughter won her case, it came at a tremendous cost. Such an emotional toll is immeasurable, but what took her six months to fix could have been challenged immediately, before it became a $60,000-problem compounded by grief.

You might also like:

Rare Bird delivers versatile marketing and digital solutions to diverse clientele across nearly every industry. Ready to leverage our expertise to address your business needs?

Let's talk.